Published: August 28, 2020

UT Finance Interns Survey Gen Z Banking Habits

With the advent of online banking options (from paying bills to transferring money and depositing checks) the need to visit a brick-and-mortar branch has become less necessary for people of all ages — and especially for Generation Z (people born between 1995—2015).

Tampa-based investment advising company Manole Capital Management recruited the help of a group of interns from The University of Tampa, University of Florida, Indiana University and Lehigh University to conduct its third annual Gen Z Financial Service Survey on banking, brokerage, digital currencies and the payment sector.

Knowing Gen Z's habits and preferences will help guide the financial technology, or FinTech, industry in the years to come. This is why the Tampa-based investment advising company Manole Capital Management recruited the help of a group of interns from The University of Tampa, University of Florida, Indiana University and Lehigh University to conduct its third annual Gen Z Financial Service Survey on banking, brokerage, digital currencies and the payment sector.

“This research was very important to do and share with the public because the upcoming trends of the banking industry play a big part in a lot of people’s investing strategy,” said Luis Delaye, who joined UT interns Laurel Jones and David MacKinnon, all May 2020 finance graduates, in the research. “The FinTech industry is an emerging industry, and it’s crucial to know what it entails and what new trends will shape it.”

The research included how often Gen Z visits a physical bank, why they would go to a bank and why they desire online banking.

“We like our interns to get their feet wet on their first research assignment,” said Warren Fisher, CEO and founder of Manole Capital, of the three-month project that was published in mid-July. “With this survey research, our interns are writing about something they truly can understand and appreciate.”

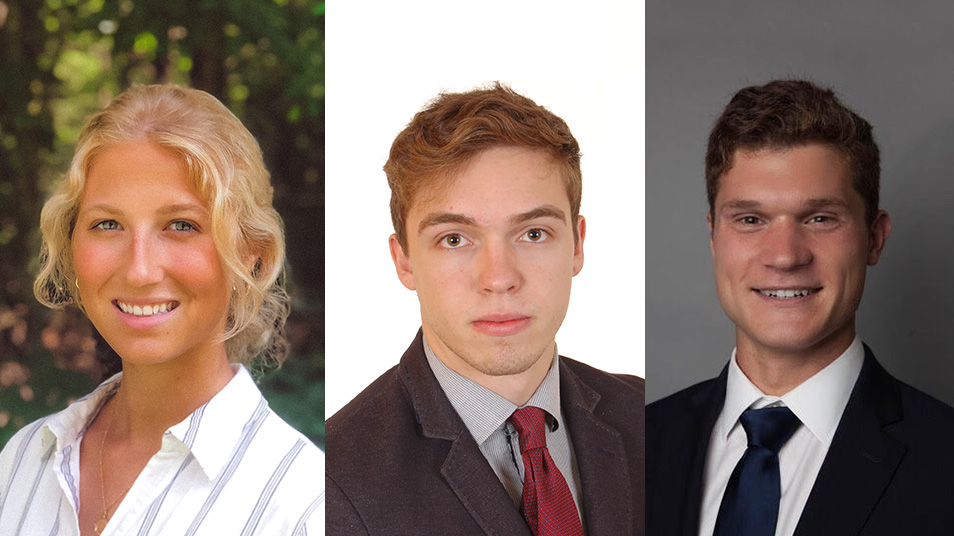

From left Laurel Jones, Luis Delaye and David MacKinnon, all May 2020 finance graduates, were interns for Manole Capital this summer.

The interns received 247 responses to the survey from their target audience.

One of the most significant findings was that over half of those surveyed said they would bank with a financial institution even if they had no physical branches. And, 64% of respondents said they would trust a traditional financial institution for banking services as opposed to big tech companies such as Google, Microsoft or Amazon.

The impact of COVID-19 played into respondents’ willingness to visit a bank: 90% of those surveyed said that it’s not “safe” to visit a bank at this time, and 96% stated that they use online banking only. Overall, the data from Manole Capital’s research shows that the FinTech industry has a promising future, particularly as Gen Z emerges into the workforce.

But no research project comes without difficulties, and the group had its fair share. Due to the COVID-19 pandemic, the meetings and collaboration between interns was all virtual, which became difficult at times.

“During COVID-19, adapting to the online environment and continuing to stay motivated from home [was difficult], given it was relatively unstructured and you had to take the initiative,” said MacKinnon, who worked on gathering and synthesizing the data. Delaye, who completed part of the internship in his hometown of Sao Paulo, Brazil, also said that scheduling virtual meetings became difficult with interns scattered throughout the world.

Still, the team was able to create a research paper covering Gen Z and banks from a variety of angles, while also taking away key skills to carry in the rest of their professional careers.

“[The project] grew my strategic thinking and opened doors for opportunities in a research role,” said Jones, who said she improved her analytical and data collection skills as well. She and MacKinnon are continuing with Manole Capital on remotely researching payment gateways (online payment processing services) while the two both pursue a Master of Science in Finance at Georgetown University this fall.

For some interns, this was the first long-term research project they worked on from the very start to the end. After collaborating remotely in the midst of a pandemic, and still coming out with a cohesive paper, it was exciting for the team.

“After working on the project for so long it felt great to finally finish and send it to the publisher,” said Delaye. “We were very proud of the work we had done and were excited to be able to publish and share it with the public.”

Story by Mallory Culhane '21, journalism major

Read more UT Life stories.

Subscribe to News and UT Life.